What you will learn from this article:

- Widespread Adoption and Investment in AI: Retail executives across the globe are rapidly adopting artificial intelligence, with 85% having developed AI capabilities and 53% planning further investment in the coming years.

- AI as a Driver of Competitive Advantage: Retail leaders are using advanced data capture and analytics to power smarter business decisions, enhance service and streamline supply chain management.

- Strategic Motivators: Retailers are adopting AI primarily to personalize customer experiences, optimize supply chains and improve inventory forecasting, balancing customer needs with operational efficiency.

Artificial Intelligence (AI) is no longer just a buzzword in retail – it's rapidly becoming the backbone of innovation, efficiency and customer engagement. According to the Global Retailer Technology Survey, executed by Honeywell and Wakefield Research, AI is driving a significant transformation across the industry, reshaping everything from customer service to supply chain management. Retail executives are not only embracing AI as a core element of their business strategy but are also leveraging advanced data capture technologies to ensure high-quality, actionable information is at the heart of their operations.

AI Takes Center Stage in Retail Business Strategy

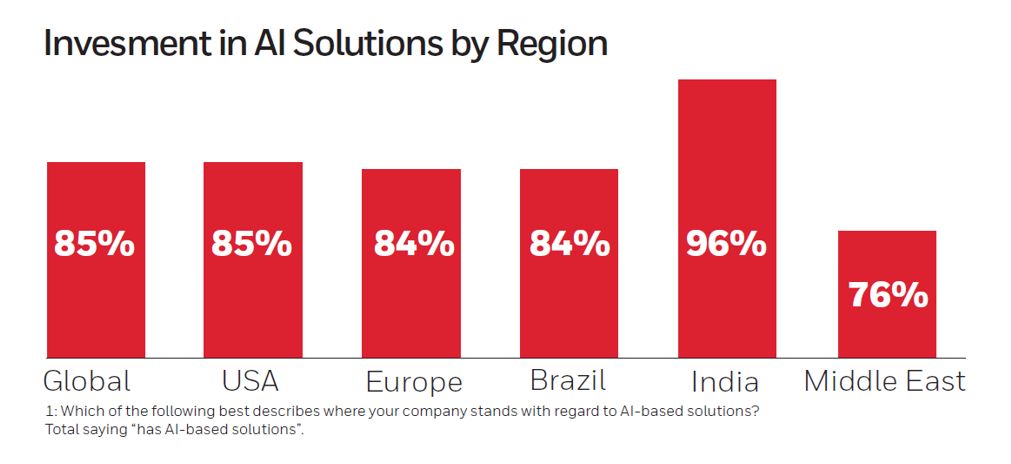

The retail industry’s adoption of AI is widespread and accelerating. Research reveals that 85% of retail executives have already developed AI capabilities and solutions, with 60% actively expanding them. Only 1% of global retail leaders have not adopted AI-based solutions or are not evaluating them, indicating near-universal recognition of AI’s value.

Retailers are dedicating significant resources to AI, with more than half (53%) planning to invest in AI capabilities over the next several years. This momentum is reflected across key markets like United States, Europe, Brazil, India, and the Middle East, underscoring the global nature of this technological revolution. For 89% of surveyed executives, investment in AI is either underway or planned within one to two years. This demonstrates a sense of urgency and commitment to integrating AI into their strategic roadmap.

Drivers Behind AI Adoption

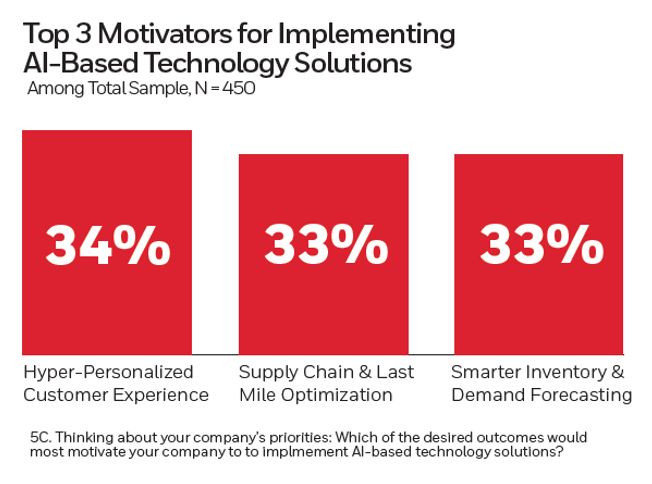

The motivations for embracing AI are clear and strategic. Retail executives identify three primary motivators for implementing AI-based solutions:

- Achieving hyper-personalized customer experiences (34%)

- Optimizing supply chain and last mile operations (33%)

- Smarter inventory and demand forecasting (33%)

These priorities reflect a balanced approach, targeting both customer-facing and back-office improvements. In regions like the U.S. and Brazil, delivering hyper-personalized experiences is especially critical, with 40% of retailers in each market prioritizing this outcome. Meanwhile, Indian retailers lead in AI investment (96%), highlighting a strong appetite for technological innovation.

AI’s Impact Across Business Functions

AI is transforming all aspects of retail, boosting customer service, shopper experiences, marketing, demand planning and logistics. Executives expect the largest impact in marketing and customer engagement, with C-suite leaders particularly optimistic about improvements in these areas.

Automation: Streamlining Retail Operations

Automation is a recurring theme in the research, with 70% of retailers having completely or mostly automated their data capturing processes. This automation minimizes manual intervention, reduces errors, and accelerates workflows. The benefits are tangible: 80% of executives at companies with mostly or fully automated data capture rate their ability to obtain trusted, high-quality data as “very strong.” This confidence is even higher (83%) among companies with an IT function dedicated to AI.

Still, nearly half (46%) of executives describe their data capture as only “somewhat or a bit” automated, highlighting opportunities for further investment and optimization. As retailers continue to automate, their ability to leverage AI and advanced analytics will only grow stronger.

Advanced Data Capture: The Foundation of High-Quality Insights

As AI becomes embedded in retail workflows, the need for high-quality, reliable data grows exponentially. Retailers are deploying a variety of advanced data capture technologies to ensure their AI solutions operate on accurate, bias-free information.

Key Technologies Powering Data Capture

- Two-dimensional (2D) Barcoding and QR Codes: Used by 64% of retailers globally, these technologies enable rapid, high-capacity data scanning, supporting everything from product tracking to customer engagement. 76% of retailers in the Middle East are using QR codes, demonstrating regional enthusiasm for adopting modern barcoding systems.

- Machine/Camera Vision: Adopted by 42% of retailers globally, these systems optimize inventory management and loss prevention. AI-powered cameras scan shelves in real time, alerting staff to low or misplaced stock and reducing out-of-stock situations. They also bolster security, detecting unscanned items at self-checkouts and helping to prevent theft and fraud.

- Optical Character Recognition (OCR): OCR automates the extraction of text from images, streamlining inventory management, invoice processing, and customer data analysis. Global adoption stands at 42% but rises to 64% in India, reflecting robust investment in efficiency tools.

- Augmented Reality (AR): Though relatively nascent in retail, AR is used by 31% of retailers worldwide, allowing customers to visualize products virtually and enabling retailers to personalize experiences and gather valuable data. The Middle East leads in AR adoption at 40%.

- Radio-Frequency Identification (RFID) and Sensors: Almost half (47%) of retailers use RFID, which provides real-time tracking and monitoring of inventory, further boosting automation and accuracy in operations. 45% are using sensing solutions today, which can assess shopper movement patterns and help optimize product placement on shelves.

- 1D Barcoding: This traditional form of data capture remains relevant, with 61% of retailers incorporating it into their workflows, often united with advanced 2D solutions.

Challenges and Opportunities

Despite the optimism, retailers face challenges in rolling out AI. The complexity of AI models and regulatory compliance are cited by 43% of executives as top concerns, while customer acceptance (40%) and workforce adaptation (38%) also present hurdles. Security risks (37%) and vendor trust and reliability (34%) round out the list of pressing issues.

For those already invested in AI, regulatory compliance is the single greatest challenge (50%), reflecting the importance of robust frameworks and partnerships for successful implementation.

The Path Forward: AI as an Engine of Retail Excellence

Retailers around the world are rapidly adopting AI and advanced data capture technologies to automate operations, enhance customer experiences, and improve inventory management. While enthusiasm and investment are high – especially in regions like the Middle East and India – challenges remain, such as regulatory compliance, customer acceptance and workforce adaptation. Despite these hurdles, the integration of intelligent systems and innovative tools is driving the retail sector toward greater efficiency, responsiveness, and operational excellence.

As the retail environment accelerates into a future shaped by artificial intelligence, the insights and strategies outlined in the Global Retailer Technology Survey are more relevant than ever.

Whether you are looking to enhance operational efficiency, personalize customer experiences, or stay ahead of regulatory challenges, Honeywell can offer guidance to navigate the new era of retail. Unlock further insights from our latest research.

Download the full report today and empower your business to anticipate change, drive innovation, and lead the future of retail.

Research Methodology

Honeywell commissioned Wakefield Research to conduct the Global Honeywell Retailer Technology Survey in May 2025. This Omnibus survey polled 450 executives at large retailers about their use of AI and other technologies via an email invitation and online survey. The following markets are represented in survey data: the United States, United Kingdom, Germany, Brazil, India, United Arab Emirates and the Kingdom of Saudi Arabia. The threshold of “large” retailer varied by country, ranging from a minimum annual revenue of $100 million in the U.S. to minimum annual revenue of $5 million in the UAE and KSA.